Financial Health Indicators

Operating Performance

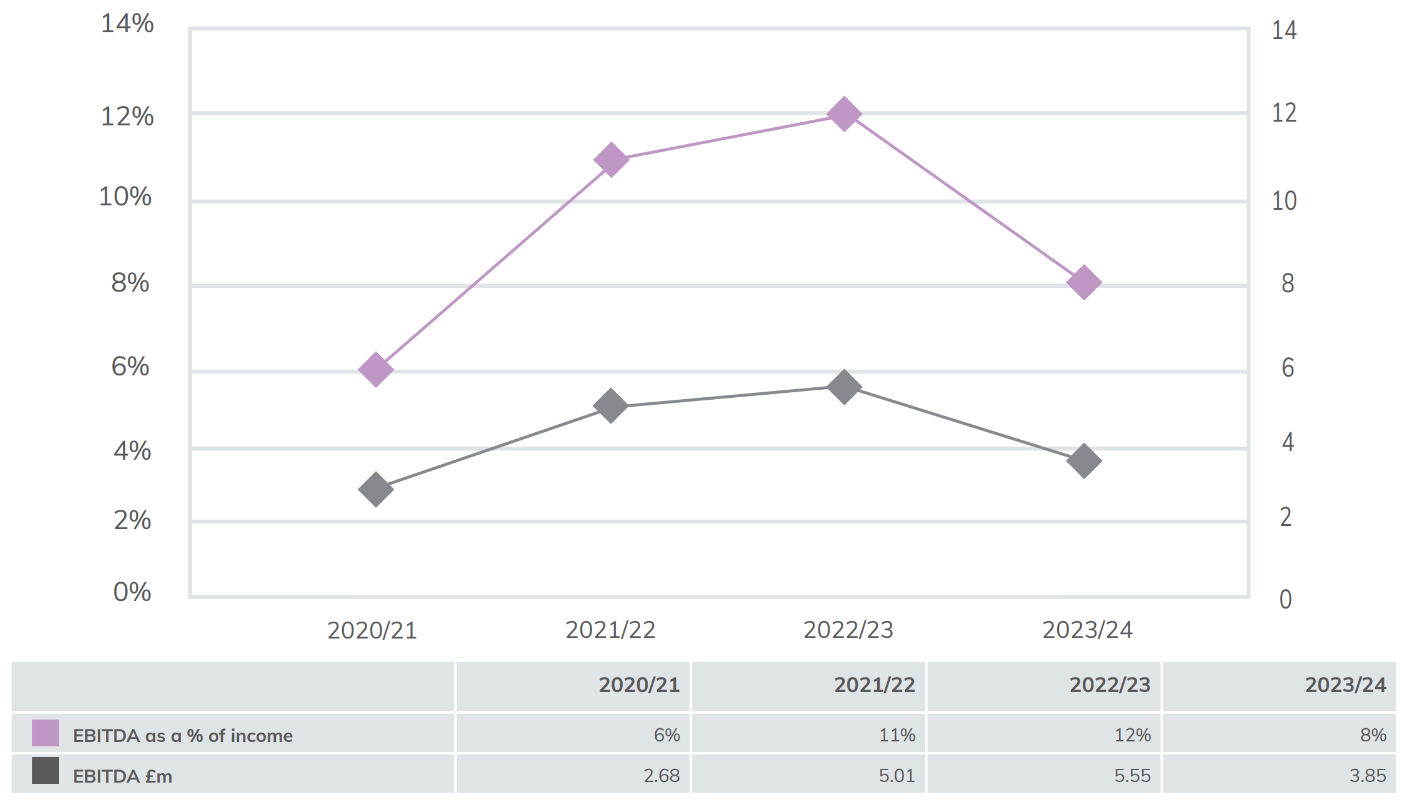

The education specific EBITDA as a percentage of income is a measure of the underlying operating strength of the College. The higher the percentage measure, the stronger the operational performance. A measure of 8% and above is the recognised benchmark by the FEC.

The investment made by the College in our Dudley and Brierley Hill Learning Quarters has resulted in growth in learner numbers and income. EBITDA is strong through ensuring costs are aligned to recruitment and teaching delivery.

Total Income

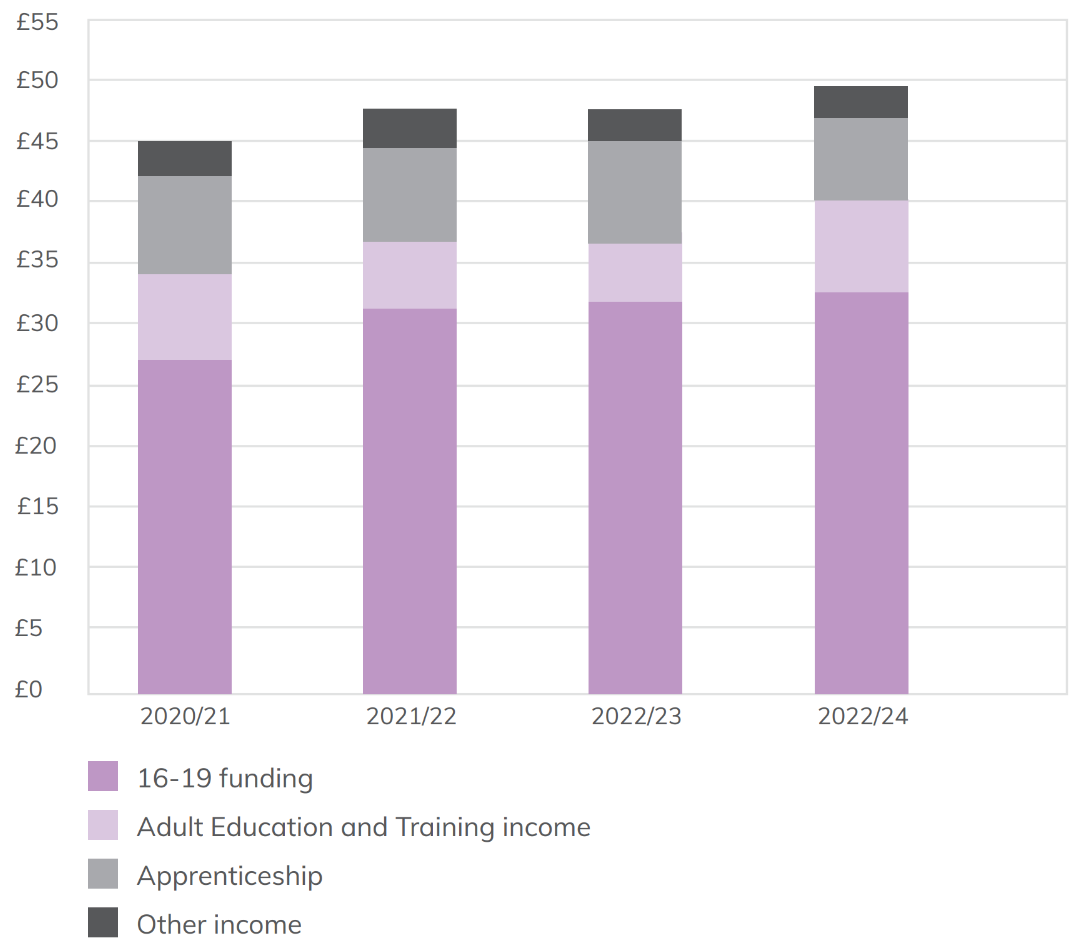

Total Income (£m)

The increase in income in 2024 is largely driven through higher levels of ESFA funding for students aged 16-19 and this will continue to grow in 2025, as a result of higher intake in 2024.

Staff Cost as a Percentage of Income

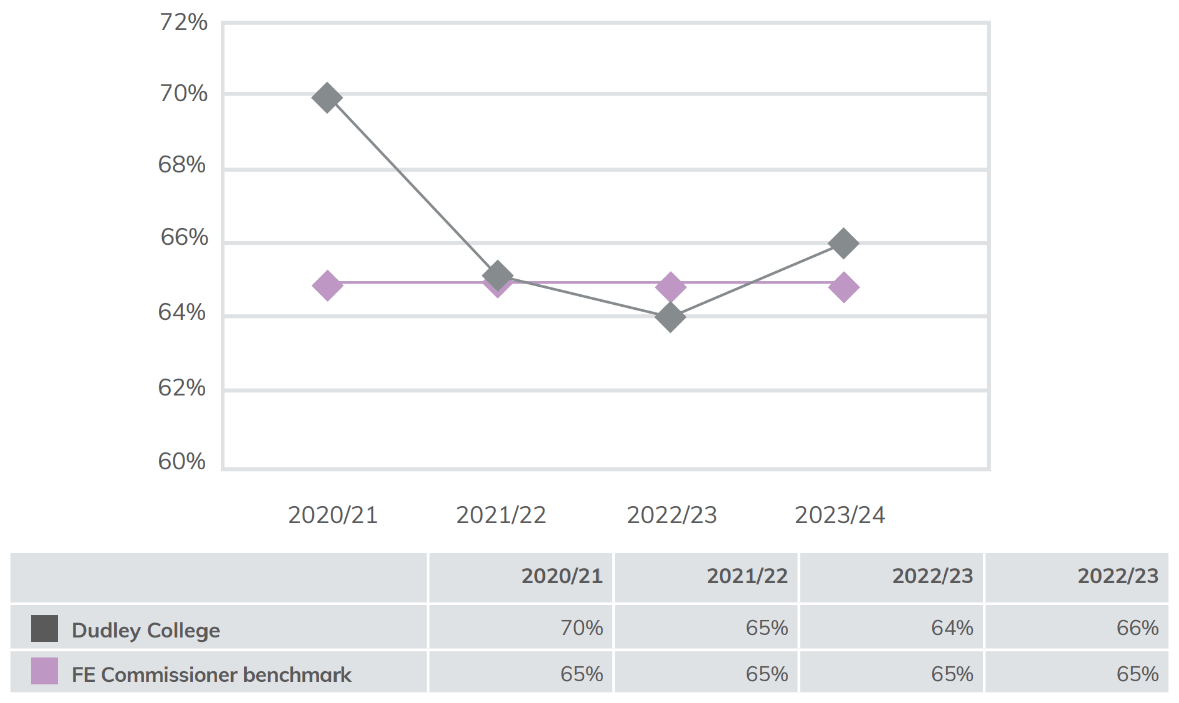

The College continues to meet the AoC recommended pay awards for staff, additional funding has been made available in 2024 to fund a cost-of-living increase of 2.5%. Pay costs continue to be tightly controlled however the growth in student numbers and income has required careful investment in new staffing posts to ensure students get the best teaching experience.

The College has also been mindful of the need to retain staff with specialist skills in order to remain flexible and respond to emerging demand in the adult and apprenticeship market. Inevitably this puts pressure on pay budgets and increases the risk of carrying vacancies for skilled staff.

The controls over pay spending will ensure a continued alignment of pay costs with delivery requirements and means that the college remains at or around the FEC benchmark of pay being 65% of turnover.

Adjusted Current Ratio

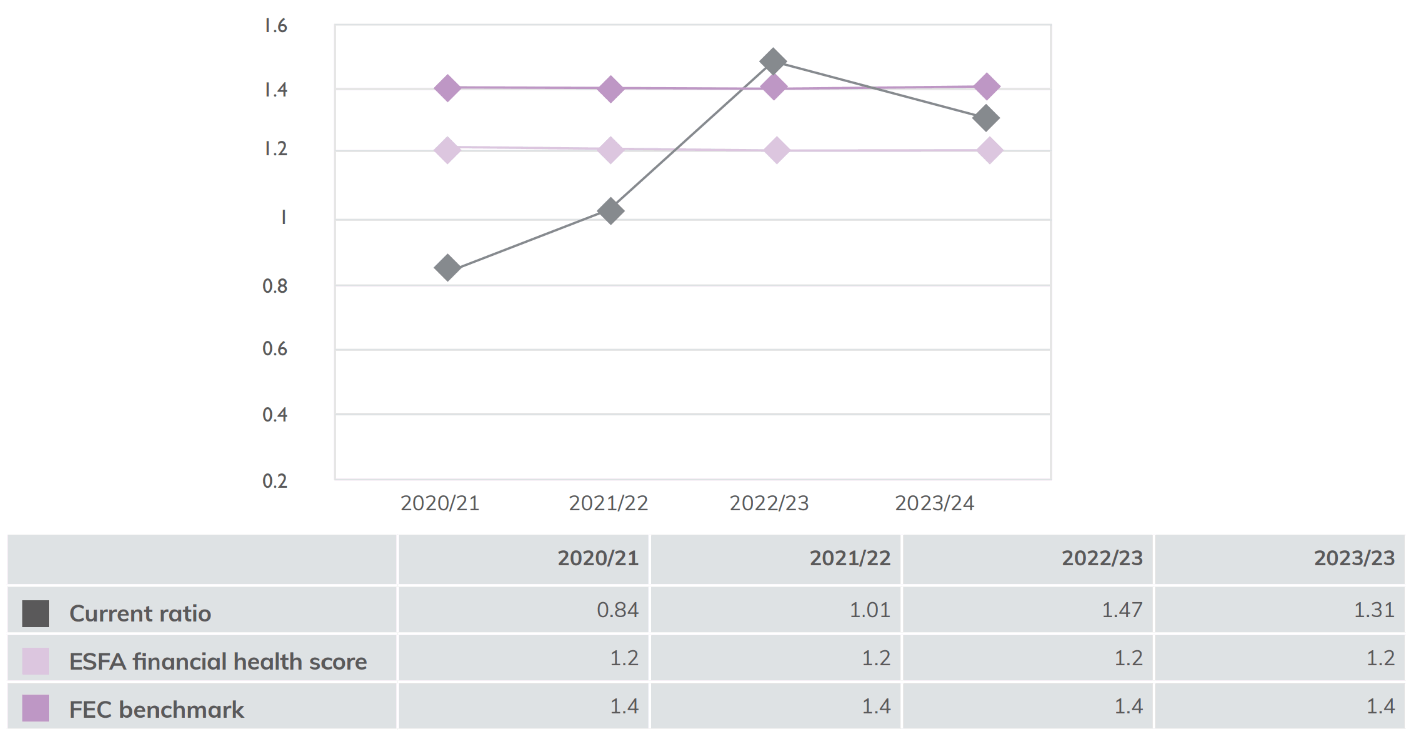

The current ratio is a measure of current assets compared to current liabilities and is used as an indicator of short-term liquidity. Whilst not a direct measure of cash, the higher the percentage measure, the better a college’s liquidity, which means the more cash, or assets that can be easily converted into cash, a college has got compared to its short-term liabilities. The ESFA ‘good’ benchmark is a current ratio of 1.2, whilst the FEC benchmark is 1.4; the College is between these two points in 2024.

The College has maintained its cash levels due to focused spend on capital projects in 2024, supported by grants from DfE and Salix; the current ratio is stable at 1.3. Cash management will continue to be important going forward as we balance the College’s liquidity needs against the requirement to repay short term borrowing. We anticipate that the College’s current ratio will continue to be strong over the next few years as we effectively manage costs, targeted capital expenditure and follow our prudent repayment plan of short-term borrowing.

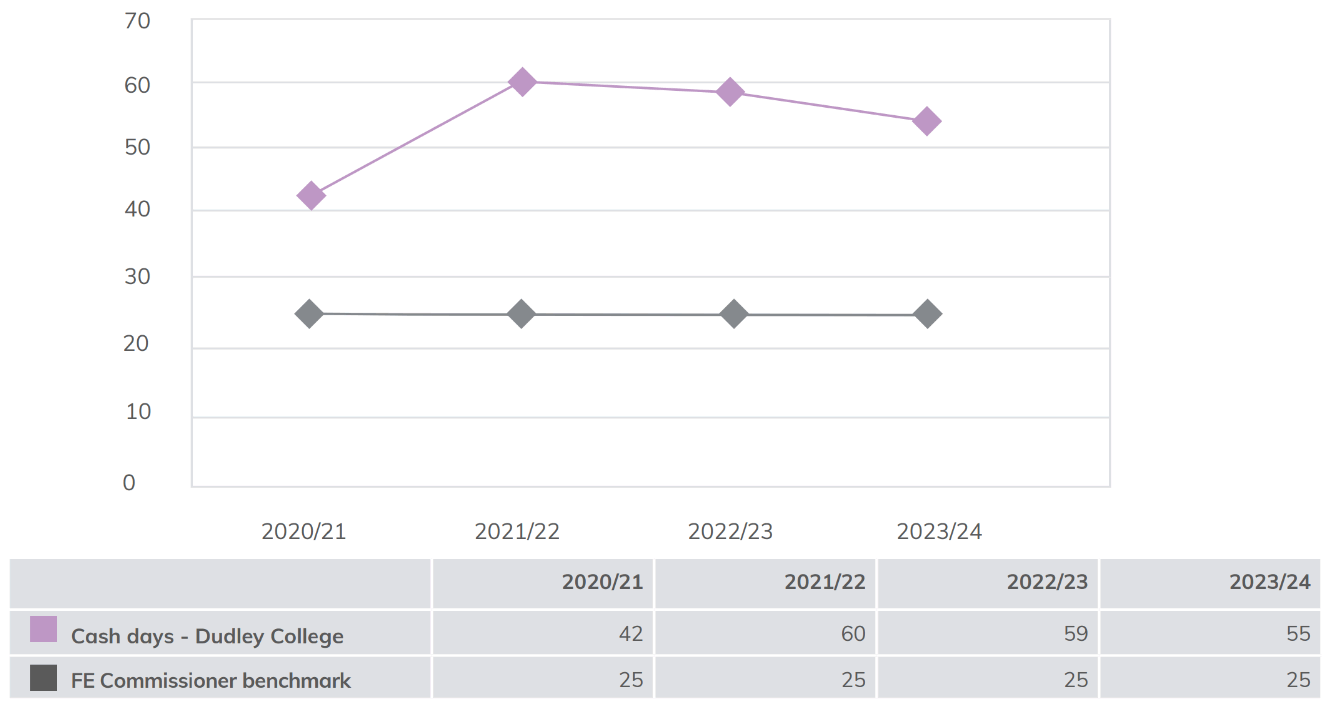

Cash Days

Cash days is the number of days that an organisation can continue to pay its operating expenses given its current level of available cash. The FE Commissioner’s benchmark is for colleges to have sufficient cash to cover 25 cash days.

Strong cash generation from operating activities has helped improve the College’s cash days to remain well above the FE Commissioner’s benchmark. Closely managed cash balances, capital investment and costs, has helped to maintain the year-end cash balance and cash days to 55 on 31 July 2024.

Cash management will continue to be imperative going forwards as we navigate through an economically challenging period. We are confident that cash, and cash days, will be maintained above the FEC target of 25.

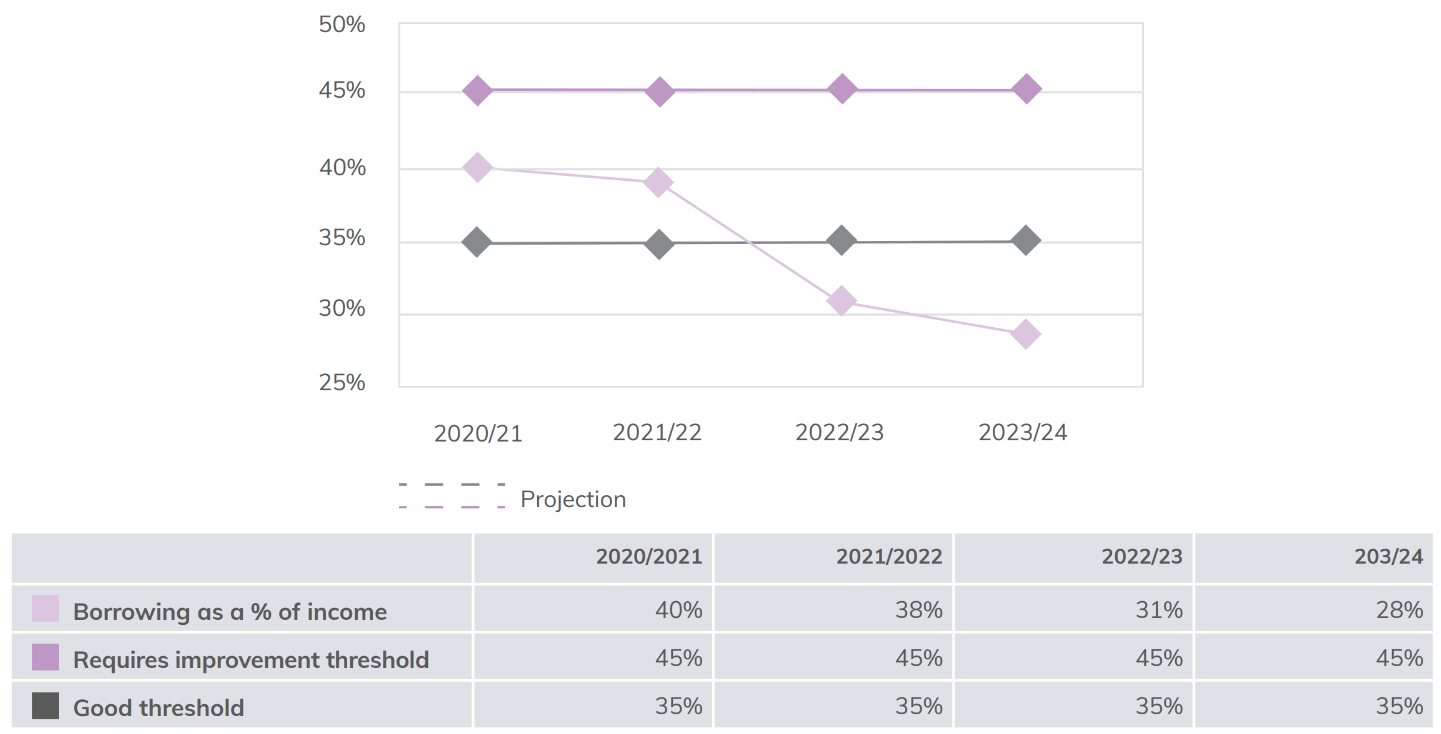

Borrowing as a % of Income

Borrowing as a percentage of income (also known as gearing or leverage) is used to measure the proportion of assets invested in a college that are financed by borrowing. It also provides an indicator to the longer-term financial stability of a college, because the higher the level of borrowing, the higher the risk as more cash will have to be set aside to meet debt and interest repayments leaving less cash for everything else. The lower the percentage measure, the better a college’s gearing and its prospects for long term stability. Colleges with a financial health score of Good are likely to have borrowing at 35% of income or less.

In addition to longer term bank loans, the College has a short-term loan with DfE which will be fully repaid by 2026. This has supported the College’s strategy of continuing to reduce reliance on borrowing and as a percentage of income, borrowing has dropped from 31% to 28% in 2024.

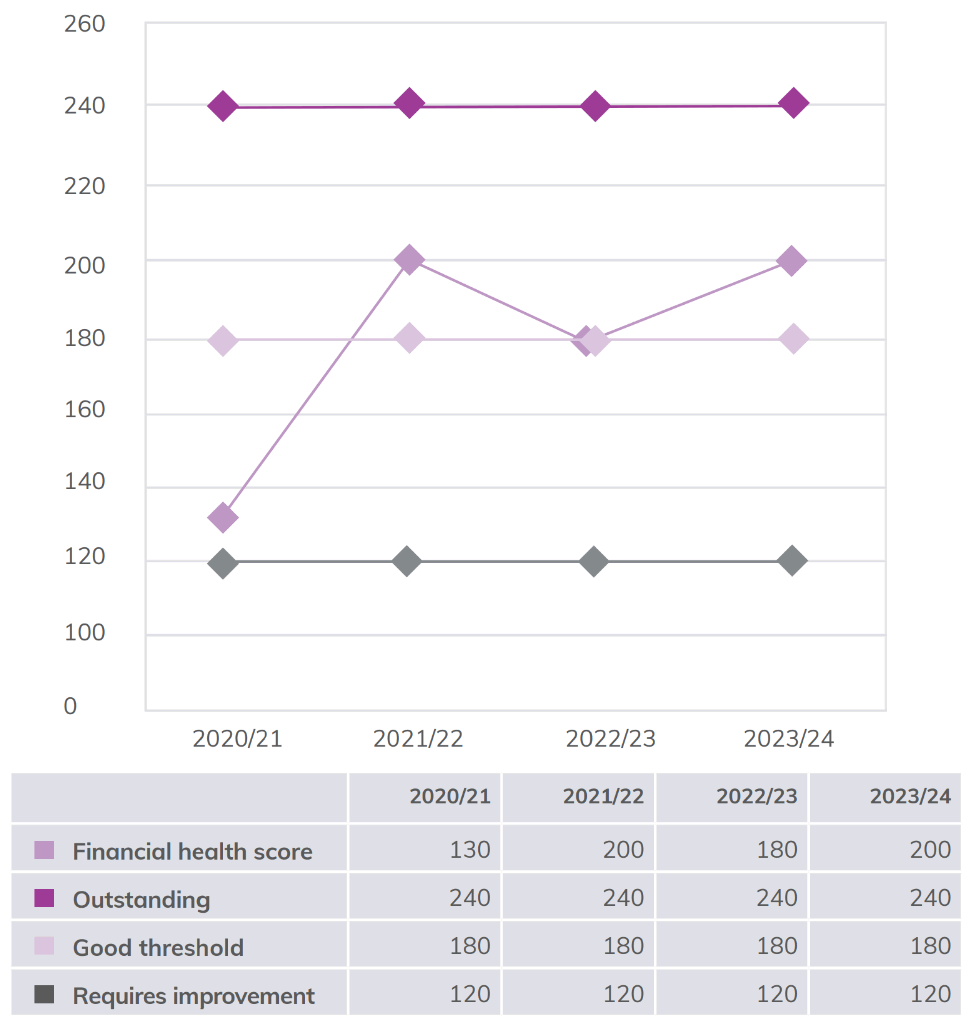

ESFA Financial Health Grade

The College’s financial health grade is assessed by scoring the adjusted current ratio, EBITDA as a percentage of adjusted income and borrowing as a percentage of income. The total scores provide an overall financial health grade, based on a banding structure illustrated in the chart.

The strong operating position and cash levels have resulted in a good financial health score.

The College expects to maintain its Good financial health score into 2025.